What Is a Financial Plan and How to Create One (9 Steps and Tips)

Effective financial planning is a basic tool that helps you gain complete control of your money, whether you're just a single person or a business owner. Individual users must learn to budget efficiently, while for companies a financial plan can be a key part of creating an online proposal for the investors.

This guide will show you how to create a financial plan, avoid common mistakes, and achieve your goals.

What is a financial plan?

A financial plan is a document that presents your future financial goals and strategies to achieve them. However, the whole process works slightly differently for individuals and businesses.

Financial plans for individual

For individuals, a financial plan is a detailed description of a long-term financial strategy for your family. It includes a comprehensive overview of your situation, including your current income, expenses, savings, debts, and bank account details.

A proper financial plan must define both long-term and short-term goals, like going on a vacation or buying a house and unpredictable events. If you work on a salary or as a freelancer, it should also include insurance and retirement benefits.

Financial planning for businesses

A company's financial plan is a detailed description of the financial situation documented as a file. It analyzes the company's income, expenses, profits, assets, and liabilities. You can prepare the plan after creating a company budget or cash flow statement to help with decisions about pricing, growth, and spending money.

Often, a financial plan is prepared to impress potential investors as part of a business plan, to prove that you have planned the first year of your business and know how to generate returns on investment.

Your plan should describe the business and include financial statements, staff management, risk analysis, and relevant KPIs.

![]() Want to know more? You can learn how to create a business plan in our Knowledge Base!

Want to know more? You can learn how to create a business plan in our Knowledge Base!

Why is a financial plan important?

Whether you are an individual or a company, a well-prepared financial plan helps you set clear goals for your future. It shows you exactly where you stand financially and helps you plan for that dream vacation or build a new lab for your company!

A good financial plan helps you understand your income, expenses, and debt, making you more financially stable and less stressed. It can help you identify financial risks, such as health problems or job loss, and provide strategies to avoid them, like insurance or emergency funds.

Most importantly, the financial planning process encourages you to think about the future, helping you balance short-term needs with long-term goals.

Benefits of a financial plan

If you create a financial plan for your company, you can reap similar benefits as above, but on a much broader scale. Here are some other ways it can help your business:

![]() Strategic direction: Helps determine business objectives and establish a clear direction.

Strategic direction: Helps determine business objectives and establish a clear direction.

![]() Resource allocation: Allocates resources to the most important areas.

Resource allocation: Allocates resources to the most important areas.

![]() Performance measurement: Uses important numbers like key performance indicators (KPIs) to measure a company's financial performance.

Performance measurement: Uses important numbers like key performance indicators (KPIs) to measure a company's financial performance.

![]() Risk assessment: Identifies potential financial risks and develops strategies to handle them.

Risk assessment: Identifies potential financial risks and develops strategies to handle them.

![]() Attracting investors: Demonstrates potential for success and financial stability of your brand.

Attracting investors: Demonstrates potential for success and financial stability of your brand.

![]() Decision support: Helps in making key business decisions, such as expanding or creating new products.

Decision support: Helps in making key business decisions, such as expanding or creating new products.

![]() Cash flow management: Helps forecast and manage daily cash flow.

Cash flow management: Helps forecast and manage daily cash flow.

![]() Adaptability to market changes: Regular review and financial plan adjustments help adapt to evolving markets.

Adaptability to market changes: Regular review and financial plan adjustments help adapt to evolving markets.

How to write a financial plan?

To create an effective financial plan, you need to set your income straight: plan the incoming and outgoing amounts over a specific period.

Then draw up a budget (or income statement) to show your income, expenses, and overall profitability during the month.

Finally, create a balance sheet to get a summary of your current assets. It is a good idea to get the help of professional financial advisors.

9 steps to create an effective financial plan

Here are some steps to consider before creating your plan:

1. Set goals

Think about why you want to create a plan. Are you planning for a vacation, business growth, or attracting investors? Use the S.M.A.R.T. method (specific, measurable, achievable, relevant, time-based) to plan your goals.

For example, if you want to double your income, consider how long it will take and what steps are needed (e.g. hiring new staff).

Setting specific goals is good, especially if you aim to reduce your expenses. Write them as the first thing in your plan, for example: "In five years, I will pay back my student loans" or "I will open another restaurant in three years".

Apart from business-related goals, think of developing a wider strategy for your business. Without a marketing plan, your business won't develop.

2. Assess the risks

Know your risk tolerance by understanding any unpredictable events that might happen. Think about what could go wrong and how you would overcome these challenges. Every company has to deal with random events at some point, so proactively plan for them.

Identify potencial risks that could threaten your business goals, like war or a pandemic. Recent years have shown these are hard to predict. Most common problems can be resolved by getting insurance and an emergency fund, but considering healthier habits can also be beneficial. For example, commuting by bike instead of a car can save on car insurance and gym or medical bills.

3. Analyze cash flow

Consider how much money your company brings in and spends monthly and annually. Cut unnecessary costs: Look for expenses you can eliminate or reduce. Are there subscriptions you don't use anymore? Can you renegotiate prices with your suppliers?

Individual customers should also track income and expenses, including costs like transportation or random income from side hustles. Don't just rely on your salary; think about other income sources, like freelancing or monetizing your hobbies. And don't forget to collect the money people owe you!

Companies should thoroughly review their past financial results to identify strengths and weaknesses and determine areas of focus. Consider developing your SWOT analysis, created by the Australian government, to improve your business sense. This doesn't have to be a main part of the analysis, but it helps with planning.

4. Make good use of your assets

If you're doing your cash flow statement for a company, summarize and evaluate your assets. Consider the value of your equipment and whether it can be used more effectively, for instance, upgrading computer equipment. This will also help you determine the insurance value.

Consider if buying or leasing is better for your business. For example, leasing a car might be cheaper than buying one, or vice versa.

Individual customers can sell unused items for extra income - if you're looking for some quick cash, consider starting a yard sale or selling all these books on your shelves to motivate yourself!

5. Evaluate your investment strategy

There are two main ways to invest: actively or passively. Actively means you pick the investments yourself; passively means a professional does it for you. Think about ways to make money besides just selling your products or services. Even medium-sized companies or individuals can invest in real estate and make a profit.

Diversify your portfolio and think - maybe you could pay back your loans using profits generated by investing in shares. Remember that investing involves risk, so consult a financial advisor to help plan any potential investment.

6. Prepare and design a financial plan

Make your financial plans simple and easy to understand. Consider publishing them as a professional-looking PDF flipbook from Publuu. You can easily share such plans with colleagues, investors, or superiors, and use its features to highlight your financial goals.

Gather all necessary financial documents: profit and loss statements, balance sheets, bank statements, cash flow statements, and profit reports.

Often, a plan is created alongside a balance sheet. If your company is big enough, you might also get reports from previous years to have a complete picture of your past and future performance. Organize these documents for easy to access - we recommend using the Publuu cloud so you can access them on multiple devices.

CONVERT YOUR PDF PLAN INTO INTERACTIVE BROCHURE TO PRESENT YOUR GOALS

7. Develop financial projections

Based on your business goals and analysis of the current financial situation, try to estimate future financial performance. These projections should include revenues, expenses, profits, cash flow, and ways of making and losing money.

Quantitative forecasting is based on existing data. Create graphs and charts that will show the tendencies of your business - the rise of sales, cash flow, and income - and then try extrapolating how they will change over time. Qualitative forecasting relies on the opinions of the experts: This is where you can enlist the help of your accountant and professional planners.

8. Take tax planning into account

Sensible tax planning can improve your financial health. While you can't avoid taxes, you can reduce the amount you owe.

Use financial advisors or search for appropriate reductions or credits yourself, depending on your country or state in the US. For example, changing your company's accounting can significantly affect your charges.

You can often deduct many expenses to reduce your taxable income. For example, the costs of personal education or employees in your business may be eligible for deductions.

9. Monitor and update

Even the most comprehensive financial plan needs regular updates. Once you finish your plan, show it to a competent person, such as a financial advisor. If you have a dedicated accountant, always ask them for their financial planning services. Even individuals should consult their friends and coworkers.

Periodically review your financial plan. Companies should review their financial plans at least once per year after budgeting or balance sheet preparation. Individuals can do it after major life events.

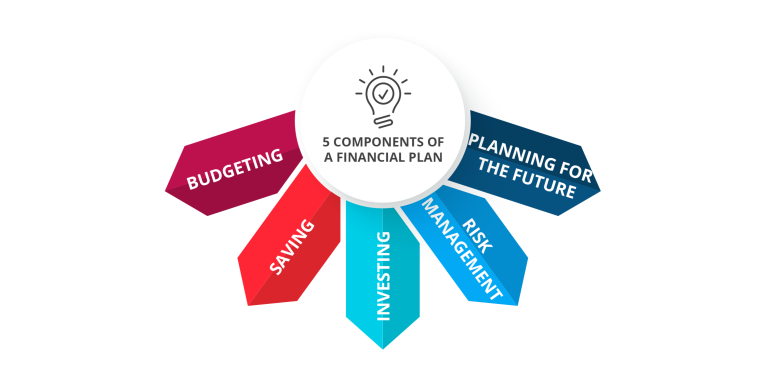

5 components of a financial plan

A well-thought-out financial plan depends on five elements:

1. Budgeting

Proper budgeting is all about keeping track of your income and expenses. Imagine that you just graduated and got your first apartment: you need to track rent, food, utilities, and entertainment to live within your means. Companies also need to budget: a local bakery needs to track flour, sugar, rent, and employee wages to stay profitable and set spending limits.

2. Saving

It's difficult to boost your funds without saving for future use, including emergencies and short-term goals. Whenever you can, plan your expenses and build up a fund. Aim to save 3-6 months of living expenses in case of an emergency. If you have a goal, like a trip or a new computer, figure out the exact cost and add a little extra for surprises.

3. Investing

You will use your savings to invest, increase your wealth over time, and keep up with rising inflation. There are different options like real estate or stocks, so pick ones that match your risk tolerance. It's also smart to invest in yourself by learning new skills.

4. Risk management

With sound investments and savings, you can avoid financial losses due to unforeseen events. Individual people should pay for appropriate insurance, like health, car, or disability and life insurance. Companies also ought to prioritize health and safety rules, as well as data security!

5. Planning for the future

Individuals should plan for a secure old age. Choose the right retirement accounts (e.g. 401(k), IRA) and invest consistently in your retirement savings. Businesses should also consider their future. Will their industry keep thriving? What might it look like in 5 or 10 years? A clothing store, for example, might need to adapt to changing consumer preferences or the rise of online shopping.

Tips and strategies to achieve financial goals

Tools and resources for better planning

Many online tools can help you and your company ensure a better financial future. We present a simple selection of basic tools for you:

-

Excel spreadsheet: This is a basic tool for financial planning, whether for a company or a person. You can use it to create a budget, calculate interest rates, or plan for the future. You can use the free MS Office online or other tools such as Libre Office or Google Sheets.

-

Budgeting apps: These can also be helpful for individuals. For most people, we suggest using an app called YNAB: You Need a Budget, available for PCs and smartphones. This app allows you to prepare a daily, weekly, monthly, and long-term budget.

-

The US government has also put together some useful free financial planning tools. These include a retirement calculator, mutual fund analyzer, or college savings planner, which can be ideal for many people.

-

Tools for professional financial advisors: These tools help with cash flow analysis, retirement planning, and tax optimization. Among the most popular choices are eMoney Advisor and MoneyGuidePro, which include artificial work intelligence-based features to improve analysis and personalize plans.

Improve your financial planning with Publuu

Instead of sending boring PDF files, companies can present their financial plans in an interactive flipbook format.

Multimedia integration: Publuu lets you add multimedia, such as videos and animations, to bring data to life and help investors understand complex concepts. This creates a consistent and professional image for your company, thanks to customizable animated backgrounds and branding.

Smooth viewing experience: Flipbooks provide a smooth and intuitive viewing experience on all devices, including computers, tablets, and smartphones. Users can easily navigate through the document using menus, tabs, and search functions to find more information about your company.

Secure and easy sharing: Your financial plans will be available in Publuu's secure cloud and can be easily shared with CFOs or investors with a single link, without sending bulky emails. Interactive elements such as forms and surveys help gather investor feedback on your financial plans.

High-resolution photos: Publuu flipbooks allow you can add high-resolution photos depicting your company's goals to make a positive impression on investors.

Engaging visual content: Psychological studies show that people are more likely to engage with visual content, and photos can increase recall and understanding. This also works for individual customers - creating a beautiful PDF with photos of beaches, for instance, can make it easier to save for your dream vacation! You can find more marketing ideas involving flipbooks in our articles.

Common mistakes in financial planning

Regardless of your age or financial situation, a well-prepared plan will help you achieve your goals and gain independence. The first step can be difficult, so here are a few common mistakes to avoid:

1. Lack of a plan

2. Lack of communication

3. No emergency reserve

4. Ignoring debt management

1. Lack of a plan

One in five Americans spend more time planning vacations than their finances. A financial plan gives you direction and allows you to track progress toward your goals. It helps in budgeting, saving, investing, and planning for retirement. For businesses, a financial plan is crucial for forecasting revenue, managing expenses, and planning for growth.

2. Lack of communication

Money is often a source of stress and conflict. It is essential to talk with your partner and family about financial goals, budgets, and spending habits to avoid any problems. The same goes for businesses! Clear communication prevents financial mismanagement.

3. No emergency reserve

Prepare an emergency fund to cover accidents such as job loss, medical issues, or major repairs. Businesses should also maintain an emergency reserve to manage unexpected costs, economic downturns, or disruptions.

4. Ignoring debt management

High-interest debt, such as credit card debt, can quickly spiral out of control. This is also useful for companies - you shouldn't rely on loans and investments!

Summary

You need a financial plan because it will help you set your goals and eventually reach them. They guide you through tracking your progress towards SMART goals and using money responsibly, eventually meaning less stress and financial freedom.

We hope that now both individuals and business owners have learned how to budget, set goals, and make investment decisions - and present relevant documents as flipbooks from Publuu!

You may be also interested in:

How to Write an Executive Summary in 8 Easy Steps

Business Writing – All You Need to Know